- Home

- School of Higher Learning

- PEARSON BTEC INTERNATIONAL LEVEL 3 DIPLOMA IN BUSINESS

PEARSON BTEC INTERNATIONAL LEVEL 3 DIPLOMA IN BUSINESS

Awarded by Pearson Education Limited

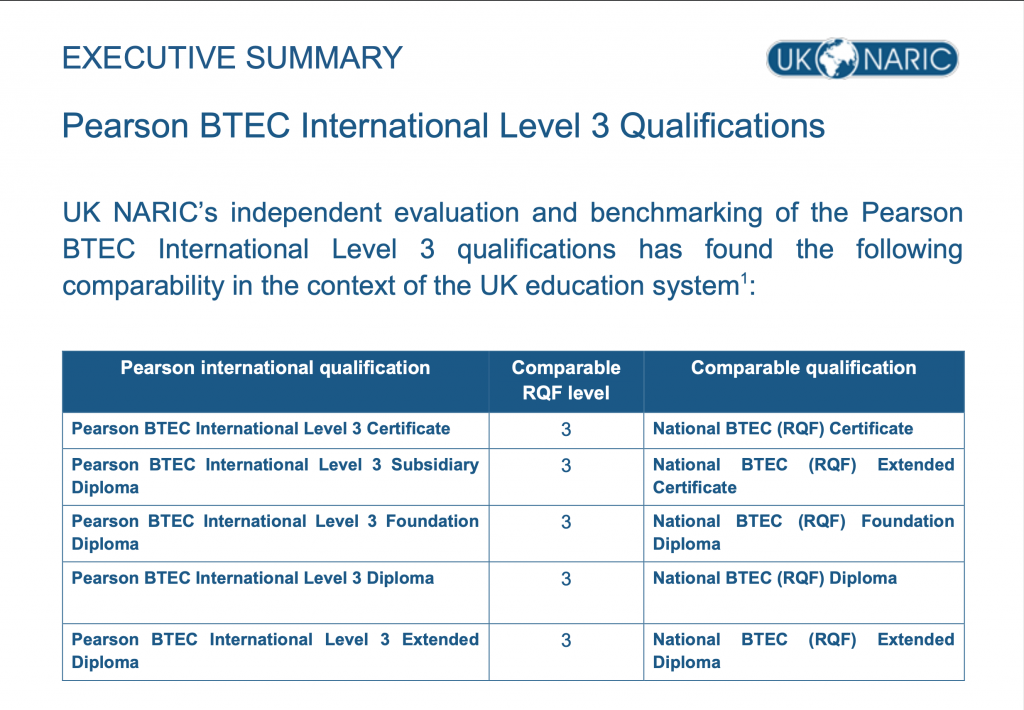

The Pearson BTEC International Level 3 Diploma in Business is awarded by Pearson Education Limited (Pearson) and is benchmarked against the corresponding qualification under the Regulated Qualifications Framework (RQF) of the Office of Qualifications and Examinations Regulation (Ofqual). Ofqual regulates qualifications, examinations and assessments in England. This qualification replaces the Pearson BTEC Level 3 Diploma in Business (QCF).

Developed in collaboration with employers and teaching professionals from around the world, Pearson BTEC International Level 3 qualifications are career-focused courses where learners apply knowledge and skills through real-life scenarios, giving them the confidence and employability skills to succeed in their professional lives.

Students enrolled in this programme undergo a variety of units covering the following content areas: business environments, marketing, finance, international business, and management.

This course is suitable for those seeking an A-Level equivalent qualification either for employment or admission to degree programmes/pathway. A non-exhaustive list of university recognition of this qualification can be found here. Learners should be aware that university admission criteria are always subject to change and understand the course entry requirements for both subject and grade before applying.

Enhanced for Singapore Financial Advisors

Students who enroll into this course at SSTC for the purpose of joining the Financial Industry and provide financial advisory services will fulfil the requirements of the Financial Advisors Act (FAA). See the section "Enrolment Terms & Conditions to Comply with FAA-N26" found below.

12 months (Full-Time)

15 contact hours/week

18 months (Part-Time)

Combination of 6 and 9 contact hours/week

*Programme duration includes term-breaks and holidays

Mandatory Units

- Exploring Business (90 GLH)

- Research and Plan a Marketing Campaign (90 GLH)

- Business Finance (90 GLH)

- Managing an Event (90 GLH)

- Business Decision Making (120 GLH)

Pre-selected Optional Units (w.e.f. Nov 2021)

- International Business (60 GLH)

- Principles of Management (60 GLH)

- Human Resources (60 GLH)

- Investigating Customer Service (60 GLH)

Other optional units, currently not offered:

- Team Building in Business (60 GLH)

- Creative Promotion (60 GLH)

- Business Ethics (60 GLH)

- Sales Techniques and Processes (60 GLH)

- Digital Marketing (60 GLH)

- Relationship Marketing (60 GLH)

- Training and Development (60 GLH)

- Market Research (60 GLH)

- Lecture

- Interactive tutorials

- Paired or group learning

- Practical lessons, if applicable

- Other interactive activities in line with current best practices

Internally assessed and subject to external standards verification. Assessments can be in the form of written assignments, projects, case studies, or demonstration of practical/technical skills using appropriate processes.

Learners who enrol into this course for the purpose of entering the Financial Services industry in Singapore are required to sit for written examinations covering at least 50% of each unit’s Learning Outcomes as a form of formative assessments. These formative assessments will undergo the process of certifiable assessments under the purview of SSTC’s Examination Board.

RECOMMENDED AGE: 16 years old on commencement of the course

RECOMMENDED ACADEMIC LEVEL: Completed Year 10 of a 12-year education system/5 Passes in IGCSE or 2 Passes in Singapore-Cambridge GCE O Level or equivalent qualifications.

ENGLISH LANGUAGE: A PASS in English Language subject at Year 10 or Level B2 in the Common European Framework of Reference (CEFR) for Languages or equivalent.

Appropriately experienced candidates who do not fully meet the above requirements will be considered on a case-by-case basis.

- At least achieve a PASS in all 5 (five) Mandatory units totalling 480 Guided Learning Hours (GLH), of which at least 2 (two) units are assessed using Pearson-Set Assignment,

- Completion of 4 Optional units totalling 240 GLH of which not more than 180 GLH are graded as Unclassified (U),

- Achieve a minimum of 72 Points Threshold.

MANDATORY UNITS

UNIT 1 – EXPLORING BUSINESS [90 GLH]

Learners study the purposes, features, structures and operating environments of business organisations, and examine the link between innovation and business survival.

In this unit, learners will:

- Explore the features of different business organisations and what makes them successful

- Investigate how businesses are organised

- Examine the environment in which business organisations operate.

UNIT 2 – RESEARCH AND PLAN A MARKETING CAMPAIGN [90 GLH]

Learners develop an understanding of how marketing research is conducted in order to plan a marketing campaign.

In this unit, learners will:

- Explore how different markets are researched using different modelsand tools

- Explore approaches to product marketing nationally and internationally

- Develop a plan for a marketing campaign for a new product.

UNIT 3 – BUSINESS FINANCE [90 GLH]

Learners develop the skills and knowledge required to analyse and interpret financial data, enabling them to assess the financial health of a business and suggest how its performance can be improved.

In this unit, learners will:

- Explore types of business finance available at different stages in the growth of a business

- Understand how financial planning tools can be used to analyse financial data and assess business risks

- Understand how financial statements for a sole trader are prepared and used to analyse and evaluate business performance.

UNIT 4 – MANAGING AN EVENT [90 GLH]

Learners will work as part of a small group to plan, coordinate and manage a business or social enterprise event and evaluate the skills gained.

In this unit, learners will:

- Explore the role of an event organiser

- Investigate the feasibility of a proposed event

- Develop a detailed plan for a business or social enterprise event

- Stage and manage a business or social enterprise event

- Reflect on the running of the event and evaluate own skills development.

UNIT 7 – BUSINESS DECISION MAKING [120 GLH]

Learners use their knowledge and understanding of business concepts and processes from the mandatory content to formulate business decisions and solutions.

In this unit, learners will:

- Examine the business principles and practices that determine business decisions

- Review and interpret business data and information

- Formulate decisions and solutions to business problems

- Prepare business documents to present business decisions.

OPTIONAL UNITS [4 units will be pre-selected for each intake]

UNIT 5 – INTERNATIONAL BUSINESS [60 GLH]

Learners explore the reasons why businesses trade globally and consider the factors that influence the implementation of international business strategies.

In this unit, learners will:

- Examine the influences on the growth of globalisation

- Explore the structure of the global economy

- Examine strategic and operational approaches to developing international business.

UNIT 6 – PRINCIPLES OF MANAGEMENT [60 GLH]

Learners develop an understanding of how the role of management and leadership in the workplace contributes towards business success.

In this unit, learners will:

- Explore management and leadership principles, concepts, key terms, functions and theories

- Examine management and leadership styles and skills and their impact on organisational performance

- Prepare proposals for business improvement to meet the needs of stakeholders in given business contexts.

UNIT 9 – TEAM BUILDING IN BUSINESS [60 GLH]

UNIT BRIEF

Learners study the dynamics of team building, examine the underpinning theory and participate in team activities.

In this unit, learners will:

- Examine the benefits of teams in a business setting

- Investigate techniques and theories used for the development of an effective business team

- Develop effective team skills through practical activities.

UNIT 17 – DIGITAL MARKETING [60 GLH]

Learners examine the different aspects of web-based marketing, and the channels that can be used to deliver a successful digital marketing campaign.

In this unit, learners will:

- Examine the role of digital marketing within the broader marketing mix

- Investigate the effectiveness of existing digital marketing campaigns

- Develop a digital marketing campaign for a selected product or brand.

UNIT 18 – CREATIVE PROMOTION [60 GLH]

Learners study how creative promotion influences the buying decisions of customers, stimulates demand, creates brand personality, and promotes products and services.

In this unit, learners will:

- Explore the role of integrated marketing communications in creative promotion

- Review the effectiveness of the promotional mix used by different businesses

- Create a plan for a promotional campaign.

UNIT 21 – TRAINING AND DEVELOPMENT [60 GLH]

Learners study training and development and recognise that successful businesses need to plan and manage the training programmes they offer.

In this unit, learners will:

- Investigate training and development in a selected business

- Examine the planning and delivery of training programmes in a selected business

- Develop an appropriate induction programme for a group of new starters in a selected business.

UNIT 22 – MARKET RESEARCH [60 GLH]

Learners examine the different aspects of market research used by businesses. They will undertake a research project, interpret their findings and produce a report.

In this unit, learners will:

- Examine the types of market research used in business

- Plan and implement a market research activity to meet a specific marketing objective

- Analyse and present market research findings and recommend process improvements.

UNIT 25 – RELATIONSHIP MARKETING [60 GLH]

Learners will study the purposes and benefits of relationship marketing and the methods used by a selected business to attract and retain customers.

In this unit, learners will:

- Examine the purposes and benefits to a selected business of relationship marketing

- Investigate the information required to implement relationship marketing

- Review the relationship marketing methods of a selected business.

All students need to attend at least 75% of classes. Students’ Pass holders are required to maintain an attendance of 90% and above to meet the Immigration and Checkpoints Authority requirement.

FULL-TIME (PUBLIC RUN)

06 January 2025

Class Days:

Monday – Friday

Class Time:

12:00 PM – 6:30 PM (inclusive of additional Guided Learning Hours for learners who require at least 900 GLH to meet FAA-N26 specific industry requirements)

Intake End-Date:

12 September 2025

31 March 2025

Class Days:

Monday – Friday

Class Time:

12:00 PM – 6:30 PM (inclusive of additional Guided Learning Hours for learners who require at least 900 GLH to meet FAA-N26 specific industry requirements)

Intake End-Date:

05 December 2025

26 June 2025

Class Days:

Monday – Friday

Class Time:

12:00 PM – 6:30 PM (inclusive of additional Guided Learning Hours for learners who require at least 900 GLH to meet FAA-N26 specific industry requirements)

Intake End-Date:

27 February 2026

FULL-TIME (CORPORATE RUN)

Please check with your HR / Training / Recruitment department for details.

PART-TIME (PUBLIC RUN)

Not Available

Students who enroll into this course for the purpose of joining the Financial Industry and provide financial advisory services must comply with the following conditions for this course to fulfil the requirements of the Financial Advisors Act (FAA):

- TOTAL GUIDED LEARNING HOURS (GLH): Total 900 hours, comprising 720 GLH of face to face lectures and 180 GLH of compulsory lecturer/tutor facilitated tutorial sessions designed to be assignment-focused and/or as a form for remedial sessions to strengthen deeper understanding of concepts.

- ASSESSMENTS: Learners are required to Pass the assignments for each unit in accordance with the stipulated Graduation Requirement section as well as all Formative Assessments in the form of Written Examinations covering at least 50% of each unit’s learning outcomes. These formative assessments are carried out in line with SSTC’s processes for certifiable examinations. A Statement of Results for the Written Examination component will be issued at the end of the course. Students must pass all the written examination for each unit to meet the FAA-N26.

- UNIVERSITY RECOGNITION: As this course is an A Level equivalent course, various universities have recognised this qualification. A non-exhaustive list of university recognition of this qualification can be found here. Learners should be aware that university admission criteria are always subject to change and understand the course entry requirements for both subject and grade before applying.

- Learners who fulfil the requirements as indicated in points 1 and 2 above will be awarded the Pearson BTEC International Level 3 Diploma in Business and will also be issued a Statement of Results for the Written Examination component as well as a Certificate of Enrolment to confirm their enrolment details and graduation status from the course.

FEES (effective from 1 January 2024)

SINGAPORE CITIZENS/ PERMANENT RESIDENTS/ NON-STUDENT’S PASS HOLDERS

| COST BREAKDOWN | AMOUNT |

|---|---|

| Course Fee | S$7,642.00 |

| Administrative Fee | S$200.00 |

| Assessment Fee | S$650.00 |

| Course Materials | S$1,080.00 |

| Fee Protection Scheme | S$119.65 |

| Application Fee | S$150.00 |

| Goods & Services Tax | S$885.75 |

| TOTAL | S$10,727.40 |

INTERNATIONAL STUDENTS/STUDENT’S PASS HOLDERS

| COST BREAKDOWN | AMOUNT |

|---|---|

| Course Fee | $11,190.00 |

| H&S Insurance | S$300.00 |

| Administrative Fee | S$600.00 |

| Assessment Fee | S$650.00 |

| Course Materials | S$1,080.00 |

| Fee Protection Scheme | $172.75 |

| Application Fee | S$600.00 |

| Goods & Services Tax | $1,313.35 |

| TOTAL | $15,906.10 |

Note: Fees are subject to change without prior notice.

Online Enquiry Form